This Article Explores

With the launch of our Initial Coin Offering (ICO) in February, we've had an exceptionally exciting debut year! We wanted to take a moment and highlight our greatest achievements in 2021. Want to read about even more highlights? Please visit our Diamond Standard Newsroom and keep pace with how we’re developing the world's only regulator-approved diamond commodity.

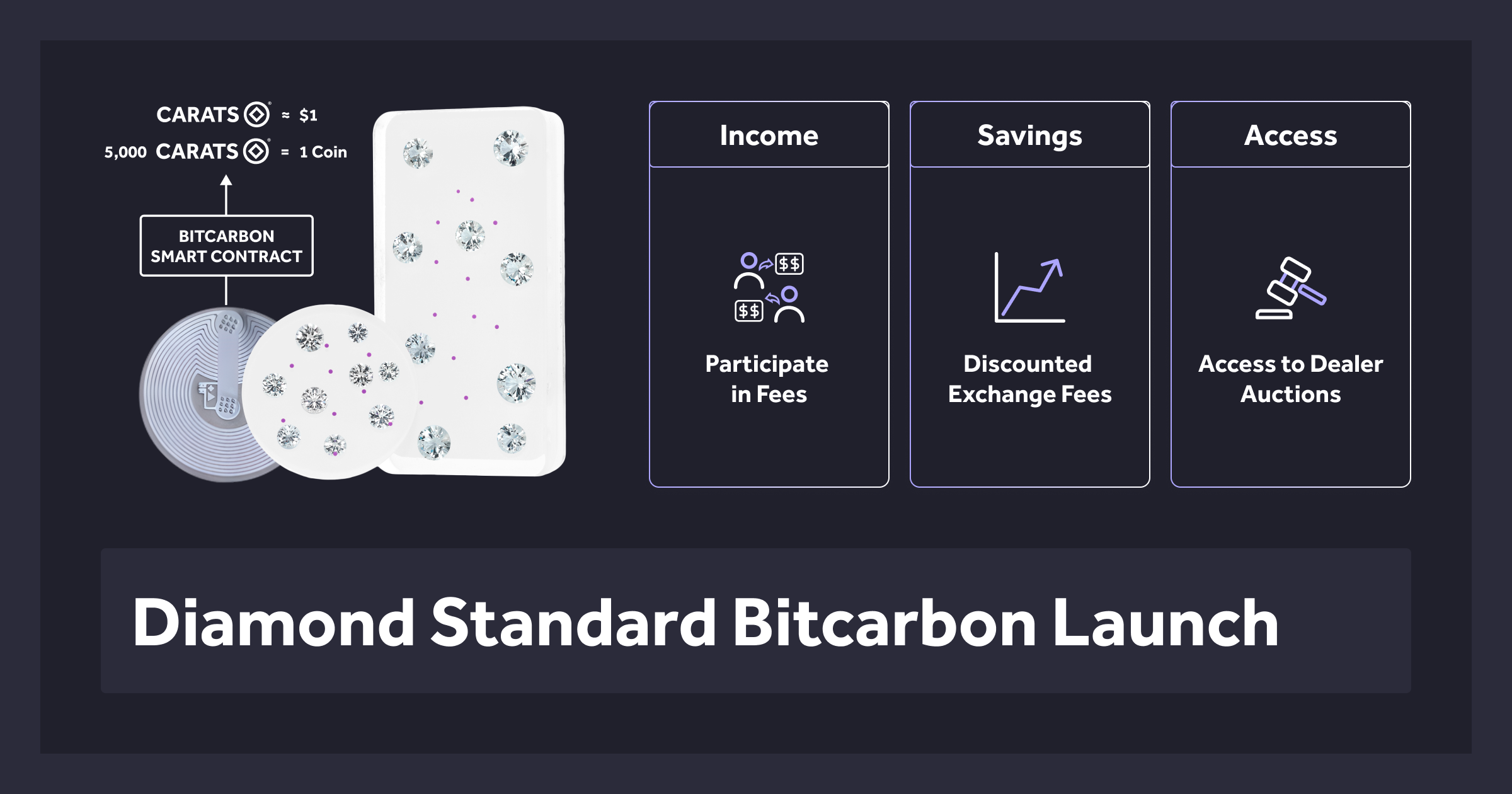

LAUNCH OF INITIAL COIN OFFERING:

Our birthday with the start of sales of our commodity product. "Diamond Standard commences sales of the Diamond Standard Coin, the first and only regulator-regulated diamond commodity. Enabling the offering, Diamond Standard announces the issuance of a regulatory license from the Bermuda Monetary Authority, and a $15-million investment round led by Horizon Kinetics."

CLOSE OF INITIAL COIN OFFERING:

Diamonds finally become an investor-friendly asset. "Additional Diamond Standard Coins will be sold to market makers and brokers through a weekly dealer auction, and directly to investors at the price established by secondary market transactions. Diamond Standard does not set the price of the commodity."

SETTING THE DIAMOND STANDARD:

The baseline "yield curve" of carat weight, cut, color, and clarity. "The index was determined by spending the proceeds of an initial public commodity offering, to force the price discovery of millions of diamonds, and to systematically purchase a large statistical sample."

LAUNCH OF FOLLOW-ON OFFERING:

The offering was capped at $50 million, across five series of $10 million each. "The initial series is priced at $5,750 per Coin, and is available to investors at diamondstandard.co. Subsequent series will follow immediately, and be priced by then-current diamond values."

OFFICE MOVE TO 565 FIFTH AVENUE:

We signed a deal in midtown Manhattan for our company’s New York headquarters. "Diamond Standard Co. signed a deal for 10,850 square feet at 565 Fifth Avenue for the company’s New York headquarters. The diamond investment provider closed on the 13-year sublease."

ANNOUNCEMENT OF DIAMOND STANDARD FUND:

New fund offers investors greater access to the diamond market in 2022. "The developer of the world’s first standard diamond-investment product is launching a $50 million investment trust to make trading the precious stones more accessible to professional investors."

More Industry Insights