This Article Explores

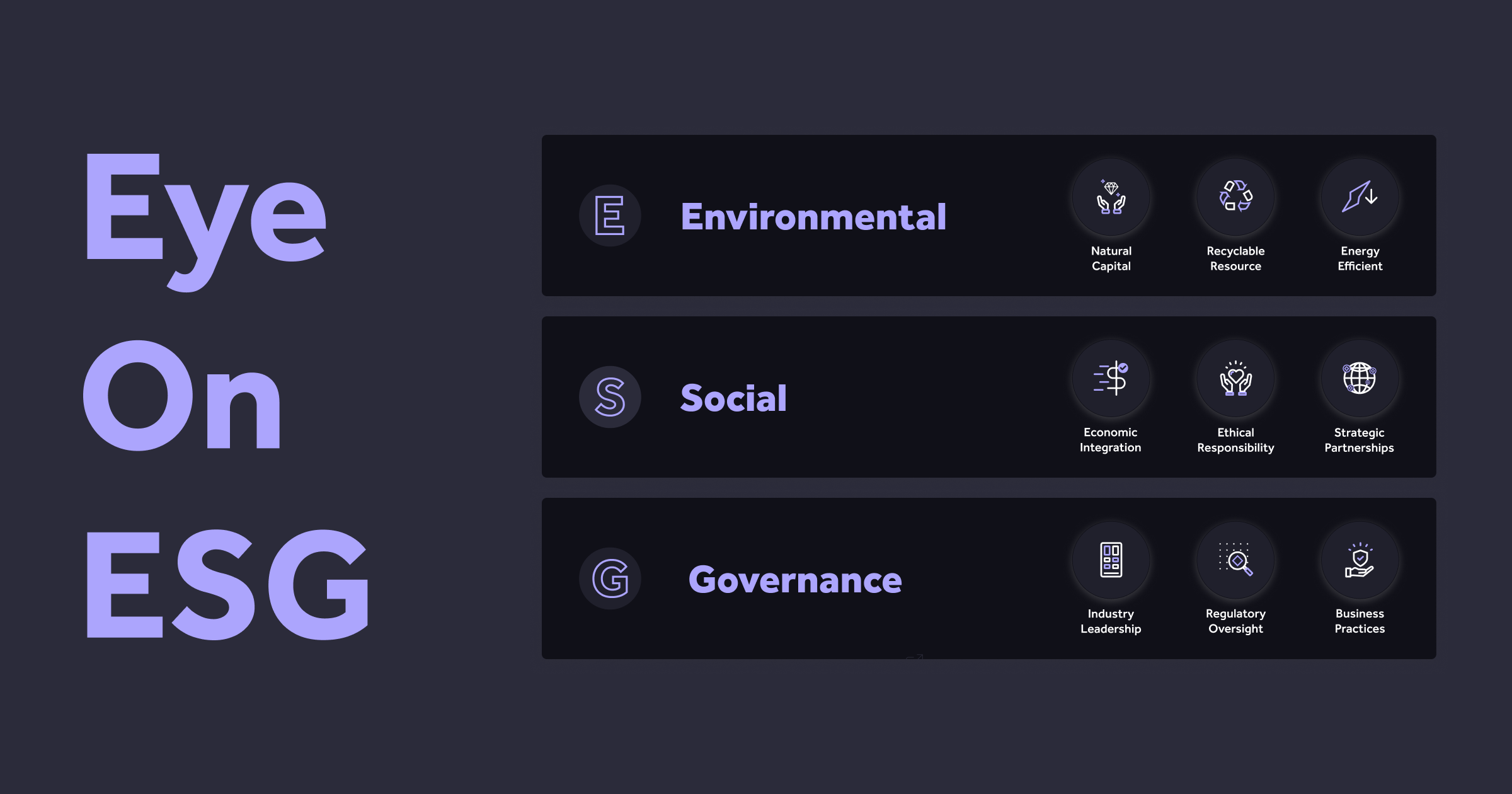

Environmental, Social, and Governance (ESG) practices have been around since the 70s and have evolved swiftly due to globalization and the rise of digital technology. With COVID-19 taking center stage in the past two years, companies have continuously put more effort into their ESG measurements. A new wave of ‘fintechs’ has led to strong demand for ESG, which as a result, has attracted a wide variety of investor interest, both individual and institutional.

According to a report from Bloomberg, global ESG assets are on track to exceed $53 trillion by 2025, which represents more than a third of the $140.5 trillion in projected total assets under management. Regardless of where the motivation stems, there’s mounting evidence proving ESG investing can provide a clear win for both investors and companies.

At Diamond Standard, we know that ESG has become a C-suite priority, so we are proud to share our 2022 ESG report for online reading or PDF download. Below, we highlight the primary focus areas that encompass our key ESG priorities as well as additional resources to learn more about our efforts.

Report Highlights:

- Our initial public offering (IPO) preparation last February created a unique opportunity to influence and improve our ESG attributes and similar assets, along with the natural diamond supply chain.

- The goals of our operating processes include the advancement of ethical, societal, governance, and transparency values.

- We call for the participation of our employees, customers, suppliers, partners, regulators and shareholders (all together our stakeholders) to achieve these goals.

Our Environmental, Social & Governance Approach:

Diamonds can be recycled indefinitely. A significant part of our multi-pronged commitment to environmental sustainability, we expect to source most of our diamonds from consumers over time. Through Diamond Standard Recycling, consumers can sell diamonds or jewelry directly to Diamond Standard, a win-win, providing unprecedented liquidity for individuals and a vast potential pool of diamonds for investors.

Diamonds can be recycled indefinitely. A significant part of our multi-pronged commitment to environmental sustainability, we expect to source most of our diamonds from consumers over time. Through Diamond Standard Recycling, consumers can sell diamonds or jewelry directly to Diamond Standard, a win-win, providing unprecedented liquidity for individuals and a vast potential pool of diamonds for investors.

As we built our company, we aimed to eliminate harmful or unfair practices from the beginning. We enforce true price discovery and transparency in our acquisition, quality control, and ESG practices. The Diamond Standard Exchange creates a new playing field – an online market accessible to all vendors. Diamond Standard Co. is committed to leading the industry in social responsibility and equity across the diamond supply ecosystem. In short, we are cleaning up the diamond supply chain.

As we built our company, we aimed to eliminate harmful or unfair practices from the beginning. We enforce true price discovery and transparency in our acquisition, quality control, and ESG practices. The Diamond Standard Exchange creates a new playing field – an online market accessible to all vendors. Diamond Standard Co. is committed to leading the industry in social responsibility and equity across the diamond supply ecosystem. In short, we are cleaning up the diamond supply chain.

As the first regulated diamond commodity, we set the standard for best practices for other commodity token producers. Our commodity and token offerings are overseen by the Bermuda Monetary Authority and our production is internally audited by Deloitte. Our partners submit to a rigorous KYC process. To do business with us, a partner must be committed to preventing criminal access, and take anti-money laundering due diligence steps. We require strict adherence from our vendors to the Kimberley Process (KP) to prevent “conflict diamonds” from making it into our supply chain.

As the first regulated diamond commodity, we set the standard for best practices for other commodity token producers. Our commodity and token offerings are overseen by the Bermuda Monetary Authority and our production is internally audited by Deloitte. Our partners submit to a rigorous KYC process. To do business with us, a partner must be committed to preventing criminal access, and take anti-money laundering due diligence steps. We require strict adherence from our vendors to the Kimberley Process (KP) to prevent “conflict diamonds” from making it into our supply chain.

We continue to incorporate feedback from global stakeholders, including our investors, and we are always learning from industry best practices to improve our ESG transparency and disclosures. For a summary of the ESG Report, please also see our 2022 ESG Report Announcement in Diamond Standard Newsroom.