This Article Explores

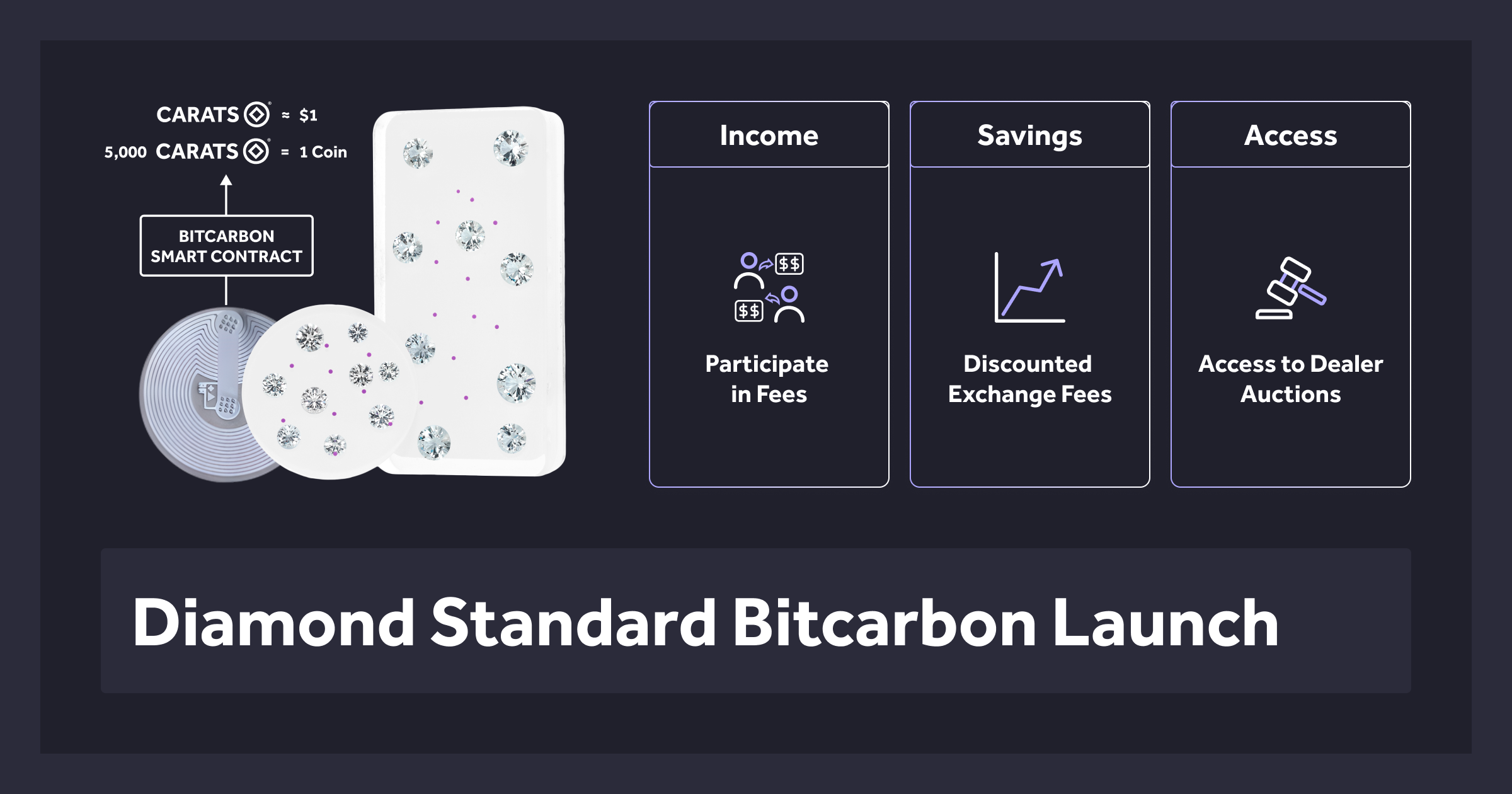

As the developer of the world’s first and only regulator approved diamond commodity, Diamond Standard helps investors to access a natural resource currently worth $1.2 trillion. To create our innovative commodity products, the company launched a brilliant way to buy natural diamonds from around the world at the best prices: Diamond Standard Exchange (DSE).

The DSE is a virtual venue that automatically bids for millions of different types of diamonds for assembly into diamond commodities.

The digital platform was built in collaboration and consultation with one hundred of the largest diamond vendors in the world. All vendors must be existing GIA (Gemological Institute Of America) and IGI (International Gemological Institute) clients and deliver the diamonds to their local IGI lab for confirmation.

The DSE can bid on 94% of the variety of diamonds -- or approximately sixteen million varieties. Every geological combination is evaluated including carat weight, color, and clarity, plus other more minor factors.

While the system benefits diamond dealers seeking to sell their inventory, it also must meet the key needs of commodity buyers that require a fair market price. For all stakeholders, the DSE system aligns three key requirements: Automation, Authenticity, and Approval.

Automation: Every time the DSE buys a diamond, the bid is transparent to force price discovery. The selling market tells the buying market, on a regular basis, what every variety of diamond is worth. When the DSE buys these diamonds, it is done on a global basis to minimize regional differences.

Authenticity: The diamonds are graded and certified by the IGI and GIA. The DSE purchases only conflict free and ethically sourced stones. Sellers must be registered vendors only -- retail customers can not participate.

Approval: The purchase and assembly of diamond commodities relies upon independent third parties to verify the process. Diamond Standard offerings are internally audited by Deloitte. In addition, offerings are regulated and licensed by the Bermuda Monetary Authority permitting the company to issue, sell, and redeem tokens and digital assets.

For Diamond Standard’s initial public commodity offering, the DSE placed over five million bids to purchase tens of thousands of diamonds from around the world. The diamonds that made the final cut met Diamond Standard’s high bar for ethical sourcing, quality, and value per dollar.

Vendors seeking to participate in the DSE are welcome to contact us via email (diamonds@diamondstandard.co) or register directly on our website.

More Industry Insights